What is IRS form 2290?

The IRS Form 2290, also known as the Heavy Highway Vehicle Use Tax Return is an official document to calculate taxes for vehicles plying on public highways with a gross weight of 55,000 pounds or more. The tax form is designed for truckers to declare and file taxes annually, in-line with IRS rules and specifications. Learn more about IRS form 2290 guidelines.

What information is required to e-file form 2290?

To file your form 2290 online, you only need a few essential details including:

- Business Name and Address

- 9-digit Employer Identification Number (EIN)

- 17-digit Vehicle Identification Number (VIN)

- Vehicle‘s Taxable Gross Weight

- Vehicle‘s First Used Month

How to file IRS form 2290

with eform2290?

- Enter Business Details:

Add essential information including business name, address, & Employer Identification Number (EIN)

- Select Tax Period & Enter Vehicle Information:

Add Vehicle Identification Number (VIN), taxable gross weight, and vehicle category

- Select HVUT Payment Options:

Choose a payment option to authorize IRS to collect your taxes

- Review & Submit Form 2290:

Cross-check entered information before you submit form 2290 online

- Receive Your 2290 Schedule 1:

Post submission, download your Schedule 1 instantly

Why should you file IRS form 2290

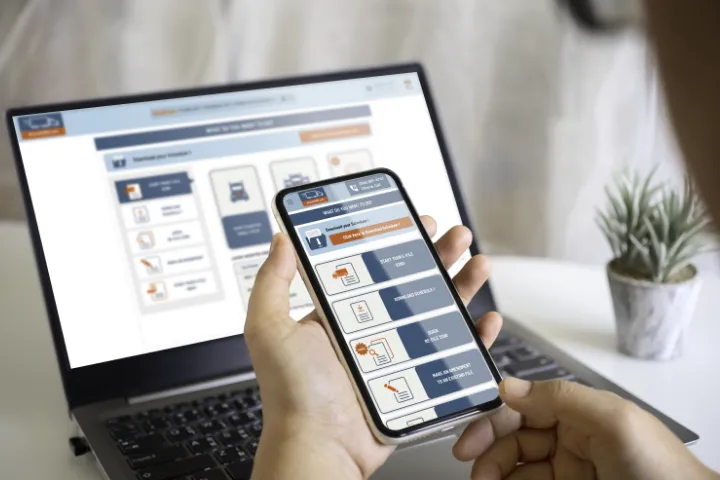

online with eForm2290?

Filing form 2290 online with eForm2290 is quick, easy, and convenient and saves you the stress of dealing with offline documentation at IRS offices. Whether you are a fleet operator, owner operator, or a tax professional filing 2290 on behalf of your clients’; you can electronically file form 2290 right from the comfort of your home. No more complex paperwork or standing in queues to pay your HVUT tax. Simply file with eForm2290 and embrace a smarter way to stay on top of your vehicle taxes.

Quick & Error-Free Filing

Bulk upload fleet information in minutes and e-file your 2290 with accuracy and precision to save precious time.

Safe, Secure, & Reliable

As an IRS- approved service, safeguarding your data is our topmost priority while keeping your trucking business compliant.

Instant Schedule 1

Receive and download your IRS-stamped Schedule 1 instantly, delivered directly to your inbox. You can access your Schedule 1 and other essentials with your login information.

24/7 Customer Support

Get round the clock filing assistance and answers to all your form 2290 related questions from our multilingual tax experts, trusted and recommended by users with 17k+, 5-star reviews on Google, Facebook, and Trustpilot.

Faster Approvals & Stress-Free Filing

File 2290 online anytime & anywhere in a few steps. Skip offline visits to the IRS office and enjoy quicker submissions and approvals.

DIY & Assisted Filing

Start self-filing in a few clicks or call us to dial and file your Form 2290 with expert assistance.

What’s the total 2290 tax due for your truck?

Calculate instantly!

Want to be double sure before you file form 2290 for your truck? With our Form 2290 tax calculator, you can easily check and verify the tax amount before you proceed for the filing process. All you need are a few basic details and you’re good to go! Our tax calculator is quick and shows the exact form 2290 tax amount before you start filing.

What’s the due date to file Form 2290?

You must file your form 2290 by August 31st every year, if your vehicle’s First Used Month (FUM) is July. If you start using a vehicle in a different month and your FUM is other than July, the deadline would be the last day of the next month. It’s always a good practice to file your form 2290 before the deadline to avoid late-filing penalties and save money. The current tax period starts from July 1, 2025 and ends on June 30, 2026.

Got an Incorrect VIN on your form 2290?

Fix errors quickly

Want to correct a VIN mistake on your form 2290? No worries! eForm2290 offers free VIN corrections to keep you on track with your tax schedule!

Frequently asked questions on filing form 2290

What is Form 2290?

Form 2290 is the official document to report, record, and pay HVUT taxes for vehicles exceeding the gross weight of 55,000 miles or more. You can file it quickly with eForm2290.Learn more about form 2290 filing and requirements.

When is the Form 2290 due?

Normally, the due date for Form 2290 is August 31st every year and depends on the First Usage Month (FUM) of the vehicle. Check when your form 2290 is due if you’ve recently purchased a vehicle.

Why to file Form 2290?

Form 2290 must be filed to be compliant with HVUT taxes applied by the IRS on heavy vehicle usage on public highways. It’s essential for smooth trucking operations.

Where should I file Form 2290?

Although form 2290 can be filed offline by visiting your nearest IRS office, e- filing 2290 can save you the rush and makes the entire process smooth and comfortable.

How should I file Form 2290?

You can file your Form 2290 with eForm2290 in just a few minutes to generate your Schedule 1 minutes. Form 2290 Schedule 1 is the official proof that your taxes are successfully recorded as per fleet information and is now in the IRS queue for review.

How much is the tax amount for 2290?

The tax amount for 2290 varies depending on factors including your fleet size, which can easily be calculated with our tax calculator. Typically, vehicles below a gross weight of 55,000 pounds are exempted whereas the ones exceeding 55,000 pounds must pay taxes as per IRS regulations.

What happens if I get late for my form 2290 filing?

In case of late filings, you will be paying over and above your tax liability as IRS penalties and interest charges will add up. That’s why it’s essential to file your 2290 on time and e-filing is the best option to save both time and money. Learn more about form 2290 late filing penalities and risks.