IRS Form 2290 Instructions

Recent Posts

Explore Other Categories

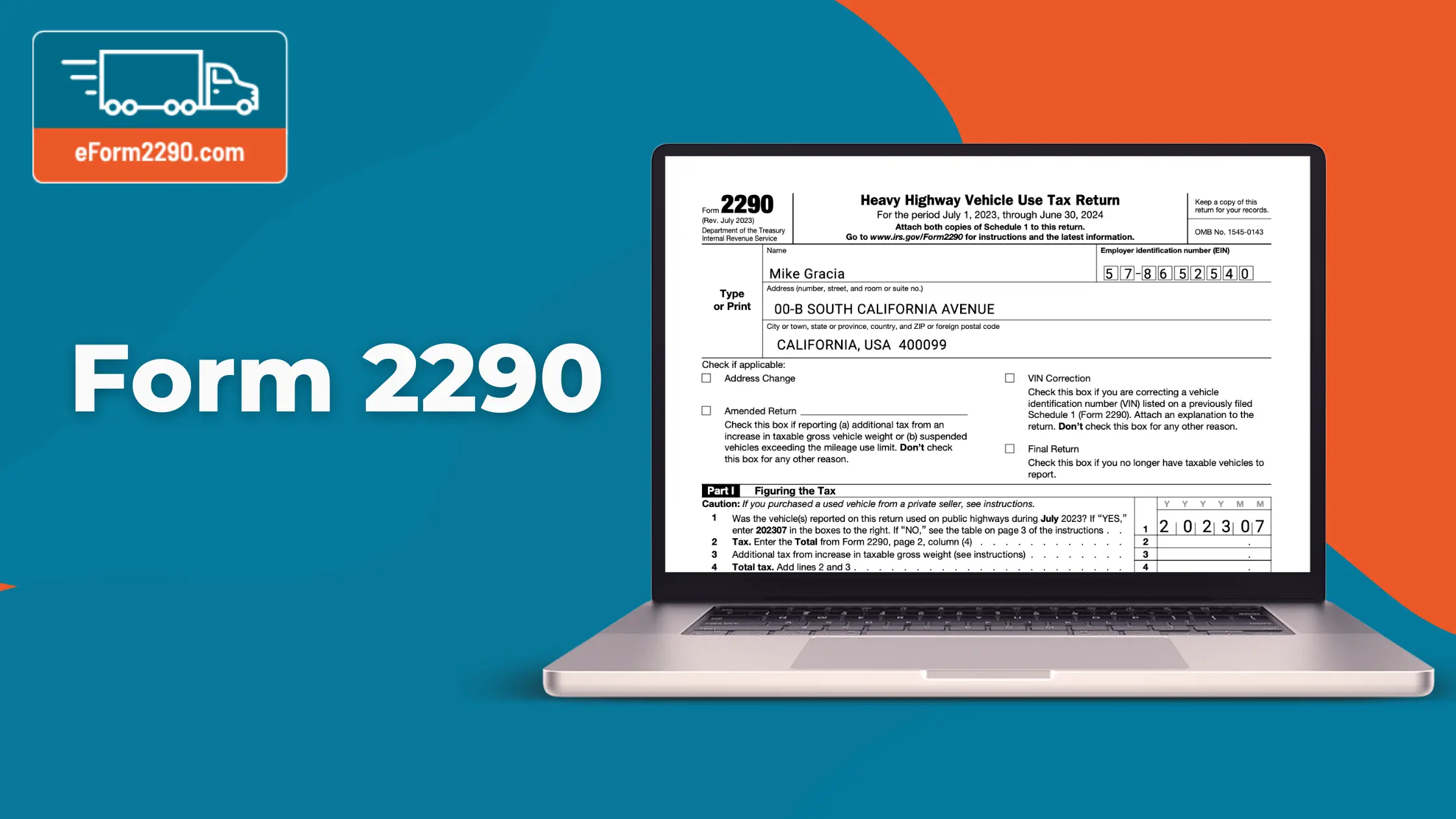

IRS Form 2290 Instructions: Your Complete Guide to Filing and Payment

This guide will walk you through the essential steps for filing Form 2290 and making your payment. Follow these comprehensive Form 2290 instructions to ensure a smooth filing experience.

Introduction to Form 2290

IRS Form 2290 is a tax form used by the IRS to collect Heavy Vehicle Use Tax (HVUT) from owners of heavy highway vehicles with a gross weight of 55,000 pounds or more. This tax helps fund highway construction and maintenance. The tax period for Form 2290 runs from July 1st of one year to June 30th of the following year. Filing on time is critical to avoid penalties and interest.

Steps to File Form 2290

Gather Necessary Information

- Employer Identification Number (EIN): Ensure you have a valid EIN. The IRS does not accept Social Security Numbers (SSNs) for filing Form 2290.

- Vehicle Identification Number (VIN): Have the VIN for each vehicle you are reporting.

- Taxable Gross Weight: Determine the taxable gross weight of each vehicle. This information is crucial for calculating your HVUT.

Obtain Form 2290

Download Form 2290 from the IRS website or use an authorized e-filing service like eForm2290.com.

Complete the Form

- Part I: Provide your business information, including your EIN, name, and address.

- Part II: List your vehicle information, including VINs and taxable gross weights.

- Schedule 1: Complete Schedule 1 to list all vehicles for which you are filing. This schedule will be stamped by the IRS and returned to you as proof of payment.

Calculate the Tax

Use the tax computation table provided in the Form 2290 instructions to determine the tax due for each vehicle. The tax is based on the taxable gross weight and the first month the vehicle is used on public highways during the tax period.

Submit the Form

E-file: E-filing is the quickest and most efficient way to submit Form 2290. Services like eForm2290.com streamline the process and provide instant confirmation.

Paper File: Alternatively, you can mail the completed form to the IRS. Note that this method takes longer to process.

Instructions to Make Payment for Form 2290 Filing

Determine the Payment Amount

Calculate the total tax due based on the taxable gross weight of your vehicle(s) and the tax period. Refer to the Form 2290 instructions for accurate computation.

Choose a Payment Method

- Electronic Funds Withdrawal (EFW): When e-filing, you can opt for an electronic funds withdrawal directly from your bank account.

- Electronic Federal Tax Payment System (EFTPS): Enroll in EFTPS to pay your tax online. Ensure you schedule the payment at least one business day before the due date.

- Credit or Debit Card: Pay your tax using a credit or debit card through IRS-approved processors.

- Check or Money Order: If you file by mail, you can send a check or money order payable to the "United States Treasury." Include Form 2290-V, Payment Voucher, with your check or money order.

Confirm Payment

After making the payment, keep a record of the transaction. For electronic payments, you will receive a confirmation number. For check or money order payments, keep a copy of the voucher and check for your records.

Final Steps and Tips

- Receive Schedule 1: After the IRS processes your Form 2290, they will return a stamped Schedule 1 as proof of payment. This document is essential for vehicle registration and other compliance requirements.

- Keep Records: Maintain copies of your filed Form 2290 and Schedule 1 for at least three years for audit purposes.

- Avoid Penalties: File and pay your HVUT on time to avoid penalties and interest. The deadline is typically August 31st for vehicles first used in July.

By following these 2290 form instructions, you can efficiently handle your HVUT obligations and ensure compliance with IRS requirements. Whether you choose to e-file or paper file, understanding the process and knowing your payment options will help you navigate the Form 2290 filing seamlessly.