Pre-File IRS Form 2290 for 2024-2025

Pre-filing is the process of filing your Heavy Highway Vehicle Use Tax (HVUT) ahead of the 2290 filing season. Pre-filing 2290 form for the tax period 2024-2025 starts on May 1st, 2024, and ends on June 30, 2024.

Pre-filing speeds up the acceptance of your e-filed 2290 return during the peak filing season when thousands of truckers rush to file their tax returns with the IRS.

Note:

Your submission for the Tax Year 2024-2025 will be processed after July 1st, 2024 when the IRS officially starts accepting returns and issuing Form 2290 Schedule 1 for the new filing year.

Why should you pre-file form 2290?

Pre-filing or early filing of your IRS Form 2290 has several advantages:

- Pre-filing saves you time and helps you avoid the rush hour during peak filing season

- By filing early, you can steer clear of IRS penalties and late filing charges

- You will receive your IRS-stamped Schedule 1 copy before everyone else

- Even if your 2290 tax return gets rejected, you will be able to make corrections and retransmit it without incurring penalties

- You will get plenty of time to cross-check details, clarify doubts, and review your submission

- The IRS servers experience technical issues during peak filing season, which could delay the processing of your 2290 return. You can avoid such issues when you pre-file your form 2290

- Pre-filing allows you to plan ahead and collect the necessary information for filing your return

Checklist: What details are required to pre-file form 2290

Before pre-filing form 2290, make sure that you have the following information ready:

- Business name, Employer Identification Number (EIN) & address (as per SS-4 form)

- Vehicle Identification Number (VIN)

- Taxable gross weight of your vehicle

- Total number of vehicles being reported

- Tax period for which you are filing

- First Used Month (FUM) of your vehicle

When to pre-file form 2290?

Pre-filing starts on May 1, 2024, and ends on June 30, 2024. eFrom2290.com will transmit your 2290 returns once the IRS officially starts processing Form 2290 for the 2024-2025 tax year on July 1, 2024.

How to pre-file 2290 form online?

eForm2290 makes it easier for you to pre-file your form 2290. All you need to do is follow the below steps:

- Login / Register for an eForm2290 account

- Add Business Information & EIN

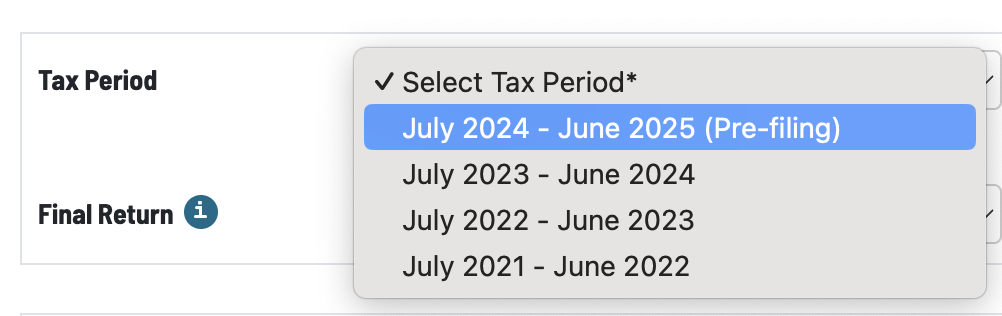

- Choose ‘Form 2290 pre-file tax year’

- Enter vehicle information

- Pay the service fee & submit the pre-filed return

Why Pre-file 2290 with eForm2290.com?

eForm2290 offers the best services to make your pre-filing easier:

- Get IRS stamped Schedule 1 before everyone else

- Free VIN Correction service

- Get alerts about the status of your return through SMS, fax and email

- Calculate your tax amount using our highway use tax calculator

- You can retransmission your rejected return for free

- Safe filing platform protected by advanced security solutions

- 24*7 customer support in English and Spanish

How to find out if your form 2290 is submitted on time?

When you pre-file with eForm2290.com, we keep you updated through text messages, email alerts and fax. If you need more information, you can always reach out to our highly experienced customer support team, who will resolve your issues and queries, should you have any.

When will I get Schedule 1 if I pre-file?

You will receive your stamped Schedule 1 copy once your return is processed by the IRS in July 2024, when the 2290 filing season officially starts.

Is it mandatory to pre-file?

It is not mandatory to pre-file your returns, although it is highly recommended that you do. Pre-filing eliminates last-minute filing errors. Moreover, you will receive your stamped schedule 1 copy before everyone else.

Final Thoughts

We know that as a trucker, you are always on the move, working long hours and juggling multiple tasks, all the while trying your best to stay ahead of the curve. Therefore, pre-filing your tax will be one big load off your mind, as it would help you avoid rush hours and stay compliant.

When you pre-file with eForm2290.com, all your data will remain safe and secure. We will transmit your form on your behalf the moment the IRS starts accepting form 2290 returns. Don’t race against time to file your returns. Go ahead and pre-file today with eForm2290.com.