Form 2290 Instructions: Complete Guide to Heavy Vehicle Use Tax

Form 2290 is an IRS tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. The IRS mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date.

This tax form goes by many names like HVUT (Heavy Vehicle Use Tax), heavy highway tax, truck tax, etc. Truck tax is a very important tax if you are in the trucking business. It’s not advisable to use your truck without filing your 2290 tax return. After the successful completion of the filing process, you will receive an IRS schedule 1 copy, which acts as proof of 2290 tax payment.

TABLE OF CONTENTS

1. Understanding Form 22902. Purpose of Filing IRS Tax Form 22903. Deadline to File HVUT Return4. Who has to file form 2290?5. Tax Exemption6. Filing Tax Form 22907. Fill Out Form 2290 Online8. Tax Benefits9. FAQsWhat is Form 2290 used for?

You can use Form 2290 to:

- Pay tax for heavy vehicles with a taxable gross weight of 55,000 pounds or more, which will be used during the tax period

- Claim credit for tax paid on any taxable vehicle which is sold, stolen, destroyed, or used 5,000 miles or less (7,500 miles, if agricultural vehicles)

- Carry out corrections on VIN in Schedule 1 that was reported incorrectly

- Report 2290 amendments such as the increase in taxable gross weight and excessive taxable vehicle mileage limit

- Report the acquisition of a used taxable vehicle for which the tax has been suspended

- Figure and pay the tax due on a used vehicle acquired and used during the tax period

- Figure and pay the tax if the taxable gross weight increases or if the vehicle falls into a new category

When is 2290 due?

You need to file your IRS Form 2290 and pay the tax annually, with the tax period beginning on July 1st of every year and till the end of June 30th of the next year. You can get detailed information about your due date by viewing our form schedule.

Who must file form 2290?

Anyone who owns a heavy vehicle in the United Nations of America is supposed to file form 2290 before the due date. You should file 2290 online if you fulfill the below criteria:

- If you own a truck with a gross weight of 55,000 pounds or more.This is the most important criteria in deciding if you need to file your form 2290 tax. The weight should be measured from an approved weighing company. You will have to provide the correct value while entering the gross weight while filing your form 2290.

- If you’re an LLC (Limited Liable Company), you must pay the truck tax.There is no exemption from filing your truck tax even if you are an LLC. You can have multiple trucks registered under your business. In such cases, you can also choose to file your truck tax together for all your trucks.

- If the vehicle is used for 5000 miles (7500 miles for agricultural vehicles) or above.You need to be precise when checking this detail. Ensure that your odometer was not reset before you check for this. Alternatively, you can check the length of your consignments to get an idea of how much miles you have used your truck.

Who is exempted from filing 2290 Form?

- Qualified QSub (treated as a subsidiary of the parent corporation)

- Eligible single-owner disregarded entity (a business that remains independent from its owner for tax filing purposes)

- Taxable vehicle with dual registration

- Vehicle operated under a dealer's tag, license, or permit

- Logging vehicles exclusively intended for the transportation of products harvested from forested sites, such as timber

- A vehicle that is owned and operated by the Federal Government.

- A vehicle that is owned and operated by the District of Columbia

- Vehicles owned by the local governing authority or the State.

- Fire trucks, ambulances, rescue vehicles and vehicles used for other emergencies services

- Vehicles used for the welfare of Indian Tribal Community

- Vehicles specifically designed for non-transport purposes

- Vehicles that do not use highway for transportation

How do you file your Form 2290?

There are two ways to file your Form 2290:

- Electronically through e-filing:You can file your Form 2290 electronically to the IRS through a trusted IRS authorized e-filing provider such as eForm2290.com Once filed, you will receive a stamped Schedule 1 copy within minutes.

- Manually through paper filing:You can also file your taxes manually to the IRS office. But unlike e-filing, you will receive your schedule1 copy only after 5 to 45 days.

How to fill out a Form 2290?

Follow the below steps to fill your Form 2290

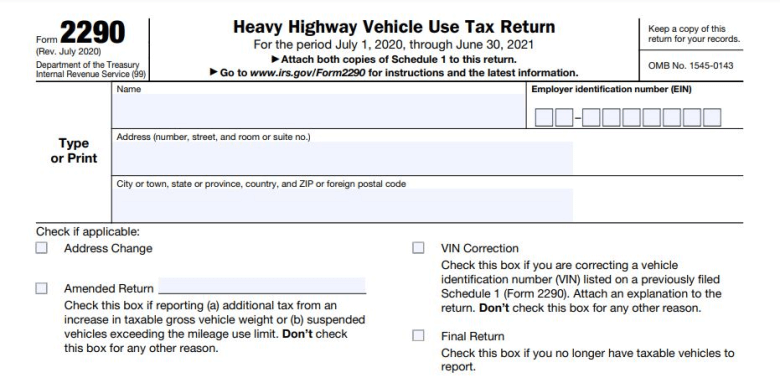

- Basic details:

Fill in your name, Employer Identification Number (EIN), and address - Purpose of filing:

Specify the purpose of filing the form such as address change, VIN correction, amend return, or final return - Details of the tax:

Enter details such as First use, tax, total and additional tax, credits, and balance due amount - Calculation of tax:

To calculate your taxes skip to page 2. You need to enter the partial-period tax (the period in which the vehicles are first used after July) and the number of vehicles. - Details of suspended vehicle (if applicable):

Specify details such as Miles used, Vehicle Identification Number, details of who you sold the vehicle to, date of transfer, and the place. - Details of third-party designee:

Specify if you want another person to discuss the return with the IRS. If yes, specify his/her name, phone number, and Personal Identification Number - Declaration & signature:

Once you’ve entered the details, sign the form and specify the date along with your phone number

Follow the below steps to fill your Schedule 1 (only for paper filing):

- Basic details:

Fill in your name, EIN, and address along with your month of first use - Details of vehicles:

being reported Enter Vehicle Identification Number (VIN) and vehicle category - Summarize:

Specify the total number of vehicles reported, the number of vehicles for which the tax is suspended, and the total number of taxable vehicles by subtracting the former numbers. - Signature and consent:

Once you have completed the aforementioned details, you will need to give your consent to the disclosure of tax information. Add your signature, name, data and EIN.

Advantages of filing Form 2290

- When you file your 2290 tax on time you, reduce the risk of penalties and additional charges

- You will be able to register your vehicle at the DMV

- Having a clear tax record will help you in the future while investing or purchasing property

- You will be able to continue using the highway only if you’ve cleared your dues

- You will be eligible to operate a heavy vehicle if you’ve paid your road tax

Frequently Asked Questions around Form 2290

Q. Is there a penalty for late filing Form 2290?

A. Yes, if you are late to file your truck tax returns, the IRS can charge you up to 4.5% of the total tax amount as a penalty if you do not file your truck tax. You will also incur an additional penalty of 0.5% for late filing. Therefore, you should be always on time to file your form 2290 online.

Q. How much does 2290 tax cost?

A. Your taxes are calculated by taking into account the taxable gross weight of your vehicle. You can calculate your tax amount using our 2290 tax calculator.

Q. Where to mail Form 2290?

A. If you are mailing your Form 2290 without payment, you can send it to:

Department of the Treasury

Internal Revenue Service

Ogden, UT

84201-0031

If you enclosing your payment (check or money order) along with your Form 2290, then you can send it to:

Internal Revenue Service

P.O. Box 932500

Louisville, KY

40293-2500

Q. How to find out if the IRS has received your return.

A. If you’ve filed your HVUT through an IRS approved e-filing provider like eForm2290.com, you will receive an email notifying the status of your form. For prompt alerts through SMS, fax or emails, sign up for a free account and file 2290 online with eForm2290.com.

Final Thoughts

Although the tax filing process can be overwhelming, choosing the right e-filing partner who offers secure and streamlined services will go a long way when timely payment is the need of the hour. eForm2290.com is one of the best options you can use to file your IRS Form 2290.

Besides being extremely secure, eForm2290.com also offers you a dashboard interface which is very helpful if you are a regular tax filer. You can also access your previous years filing if you use eForm2290.com to file your truck tax online.