Get a Copy of your Form 2290

The purpose of filing IRS Form 2290 is to report the proof of the heavy vehicle use tax paid for the use of a vehicle weighing more than 55,000 pounds on the highway. The form must be filed by the last day of the month following the month in which the vehicle was first used on public highways.

What is 2290 form used for?

Form 2290 is used for filing your Heavy Vehicle Use Tax with the Internal Revenue Service. The Schedule 1 that is received after filing IRS Form 2290 acts as proof of your payment and must be readily available in the vehicle.

Why do I need a form 2290?

Your contribution through 2290 filing enables the Federal Government to maintain public highways in the United States, crucial not just for the transportation industry but for the entire US economy.

A copy of this stamped Schedule 1 must be carried in the vehicle at all times. You can get your copy of Form 2290 or access the schedule 1 Form 2290 online by visiting the IRS website or through the service provider with whom you filed your tax return.

Is form 2290 filed annually?

The annual filing of IRS Form 2290 is a must. Ensure compliance by submitting the Heavy Vehicle Use Tax Form 2290 by the deadline, August 31, 2025, if your vehicles weigh 55,000 pounds or more. Your Form 2290 Schedule 1, also known as your Heavy Highway Vehicle Use Tax Return, is an important part of your vehicle use tax obligations. However, sometimes it is troublesome to obtain 2290 proof of payment, primarily because it's sent directly to the Internal Revenue Service (IRS) rather than to the business owners or individuals who use the vehicles in question.

Going about your business without the proper documentation and 2290 proof of payment can be detrimental to your smooth operation and functional stability. Continue reading this article for 2290 schedule 1 instructions on how to access your IRS form schedule 1.

Accessing your copy of the 2290 proof of payment can sometimes be difficult if you are unfamiliar with the process. Fortunately, with this informative guide, you'll be able to understand the entire process efficiently in six easy steps! Get started right away with this simple guide on how to get your own copy of your form 2290!

Who is required to file schedule 1 2290 form?

Whether you are an owner, limited liability company (LLC), corporation, partnership, or other types of organisation (including nonprofits, educational institutions, etc.), you must file schedule 1 form 2290 if you use a heavy vehicle with a gross taxable weight of 55,000 pounds or more for commercial purposes.

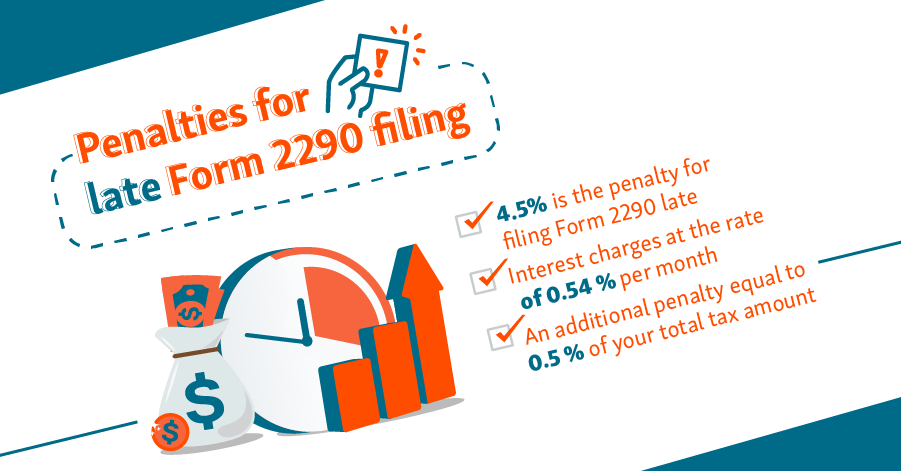

Interest and Penalties

The penalty for failing to file your IRS Form 2290 or for failing to pay your Heavy Highway Use Tax on or before the due date is 4.5%. If you fail to pay the tax for five months, this penalty increases monthly for up to five months in the following manner.

- An additional penalty equal to 0.5 percent of your total tax amount.

- Interest charges at the rate of 0.54 percent per month.

Penalties and interest add up quickly. Let us take an example: assuming you have a vehicle weighing 80,000 pounds, the tax due would be $550. If you don't pay that tax for five months, penalties and interest will accrue during that time, and the tax liability would be about $700.

If you have received a penalty for filing your return late or paying your taxes late and believe you have a valid reason for doing so, write a letter to the IRS detailing why you believe you should be forgiven. For more information on how to apply for a waiver of penalties, visit IRS. gov/PenaltyRelief or call the number on the notice you may have received from the IRS.

How do I get a copy of my 2290?

To know how to get 2290 form Schedule 1, the process is actually quite simple. There are broadly two ways to make a copy of IRS 2290 schedule 1, determined by the mode chosen by the applicant:

A. If the Form 2290 Schedule 1 is updated as an e-file: You can file your Form 2290 online and it's easy to file. Service providers such as eForm2290.com provide you with Schedule 1s instantly. You can register here. To obtain a copy of your 2290 proof of payment, simply follow these steps:

- Visit: IRS.gov/Transcripts

- Log into your account and visit the Schedule 1 Status page

- Click on "Get Transcript Online" and select the type of transcript you need from the drop-down menu under the "Transcript Type" tab

- Click the "Next" button and wait for all the years you selected to be transferred to the transcript

- Save them as a PDF file, depending on your preference

Another option is to select the "Get Transcript by Mail" option to receive a copy of your transcript. If you prefer, you can also order your transcript by calling at 800-908-9946 and request that they mail a paper copy to an address of your choice.

It is quite easy to obtain a copy of your 2290 tax proof of payment by following the step above. As mentioned earlier, accessing your copy of 2290 proof of payment by browsing the IRS website can be intimidating for most people if they are unfamiliar with the process. The difficult structure of the website and the multitude of links can be overwhelming, so you may feel confused as to begin with.

B. If a paper copy of Form 2290 Schedule 1 was filed (offline): In this case, you may have to wait longer to receive a copy of your Stamped Schedule 1. There are two ways you can request a copy of paid 2290:

You can send a fax cover sheet (signed by the company's authorised person) to 855-386-5124 The IRS will usually fax you a new stamped copy within three business days of receiving your completed fax request, which will include the previously filed Form 2290 and copies of the Schedule 1, as well as other necessary information. Complete the cover sheet in its entirety and have it signed by an officer of the company.

2. By means of a written application

With this method, all you need to do is attach your information to Form 2290 and send a request to the following mail address:

Dept. of the Treasury,

Internal Revenue Service,

Cincinnati, OH 45999-0031.

You will receive the copy of IRS 2290 schedule 1 after your request has been successfully processed.

How do I print my schedule 1 Form?

Getting a copy of schedule 1 form 2290 online is easy, but getting a print of it is even easier and effortless. You can print a copy of paid 2290 form from the IRS portal by following these steps:

- Go to www.irs.gov/Form2290

- Enter the required login credentials

- Access the Schedule 1 status page in the portal

- Select the Form 2290 you want to print and print the desired number of copies from the drop-down menu on the screen

Alternatively, If you decide to file through a service provider such as eForm2290.com, you can get it emailed to you or download it after logging in.

The Bottom Line

Schedule 1 form 2290 is a proof of heavy vehicle use tax, a certificate for your vehicles travelling on public roads. Are you looking for a user-friendly solution to fill your Form 2209? eForm2290.com is the best choice for you. All you need to do is create an account, enter your information, and start filing electronically. The user interface has been designed in such a way that a novice does not have to struggle. Log in to eform2290.com now or register and submit your file easily.

Do you have any other tips or experiences to share with those planning to have your IRS 2290 stamped Schedule 1? Share them below in a comment. Have fun filing!