As a truck driver, whether you own your own business or are working for a company, tax season can be stressful. You need to sift through so many forms, vehicle information and mileage details to complete your tax filing process. Instead of stressing yourself out, why not switch to a professional tax service and get your tax filings square and correct.

That said, there are many things that you will need to know about truck tax (HVUT 2290 Tax) as before you start preparing your tax return. That said, there are many things that you will need to know about truck tax before you start preparing your return.

We’ve compiled these details into a guide to help you understand how it works so you can feel more confident as you approach yet another tax season.

What Taxes Will You Be Paying?

The first step in learning about your taxes is to understand exactly what taxes you need to pay. This comes down to whether you own your own trucking business or work with a larger trucking company.

If you manage your own trucking business, you will be paying self-employment taxes as well as federal and state income taxes. Currently, the self-employed tax rate sits around 15%. You will need to prepare to pay taxes quarterly as well. These quarterly tax payments will be estimated based on your income, and should be roughly 25% of your total net income for the quarter.

The quarterly tax payments will be for both your self-employment taxes and your income taxes. If you are not sure where to start with your estimations, you can always reach out to your local tax filing agencies to estimate both types of taxes. This is especially important, as state income taxes vary from state to state. It is important to keep records of all your income details when you file your taxes.

If you are employed by a larger company, you probably won’t be too worried about the things above, as your employer should be deducting your taxes from your paycheck.

What Deductions Can You Apply Towards Your Taxes?

Luckily for truckers, there are no shortage of deductions you can claim on your taxes in any given year. While the following list goes into detail, it is not nearly comprehensive. If you are hoping to claim a certain expense on your tax return, you should consult a professional tax service provider for more information about said expense.

We will break down the deductions you may be able to claim into categories below. These are among the most common deductions claimed by most of the owner-operators in the trucking industry.

Travel and Personal Expenses Related to Your Business

There are many costs you incur each year due to the nature of your business, which you can actually claim on your tax return. If your travels are long enough that they require resting, you can claim any hotel costs and parking fees at truck stops.

In fact, truck drivers are required by the IRS to claim lodging expenses on their tax forms. During long travels, you may also be eligible to claim your meals on your tax form. You will have two options to claim meals, those being actual expense or per diem. If you choose to claim meals by actual expense, you will need to make sure you are keeping track of all of the bills. If you choose per diem, you will be deducting an IRS set amount per day. Up to 80% of your meals can be deducted. Of course, as we mentioned, this is only relevant if you are a long-haul trucker.

Other personal expenses you may be eligible to deduct can include clothing (if it’s driving or job-specific), laundry expenses while on the road, showering expenses, cell phones or laptops you use exclusively for work, and more.

If you decide to purchase a small toolkit, or even a minifridge for your truck, that can also be tax deductible. Just make sure that you are keeping track of every expense (and what it is). Bringing a log of these expenses to your tax preparer will help both of you ensure that you’re getting your maximum deductions.

Truck Expenses

As a truck driver, your greatest asset is clearly your truck. As a quintessential part of your work, any fees surrounding maintaining and repairing your truck are most likely tax deductible. Gas is an obvious expense that can be deducted from your taxes, so be sure to keep track of your fuel costs. If you choose to lease your truck rather than buy it, the entire monthly cost of the lease is eligible for deduction.

There is also the matter of depreciation to take into account when it comes to your truck. The depreciation for a new truck is commonly referred to as “straight-line” depreciation, as it is evenly paced in its lowering. This tax deduction is spread out through multiple years.

Other truck-related deductible expenses you should be aware of include interest on loans, annual registration fees, tires, and even washing your truck!

Medical Expenses Associated With Work

For many truckers, you need to get regular checkups at the doctor in order to stay healthy and continue to work in the industry. Any out-of-pocket cost you incur for required exams can be deducted on your taxes. If you choose to itemize deductions on a Schedule A form, you can also claim other medical consultations and hospital expenses.

Insurance Costs

There are different kinds of insurances you pay for that you can deduct from your trucking taxes. While medical insurance is not on the list, you can deduct your auto insurance, property damage insurance, and even lost income insurance in the case of a business interruption.

Trucking Association Dues

As a truck driver, you have likely chosen to become part of a union in order to connect with other truck drivers. Any union dues you may have can also be deducted on your taxes. You will just need to be able to argue that being part of the union is required, or that they are an aid to your trucking business.

Education

If you obtain an advanced license or incur any other education costs related to your business, you can claim them while filing your taxes! Just make sure you are keeping track of all of the official documents and the costs, and presenting this information to your professional tax service provider.

Other Expense You May Claim

While we already mentioned that this list is far from exhaustive, there are a few other expenses you should keep in mind when you’re figuring out your tax deductions. Any licensing fees or taxes you pay as a truck driver throughout the year can actually be included in your deductions.

If you choose to subscribe to a trucking-centric magazine or newsletter, you can also throw that onto your deductions. Also, if you have a home office, the costs of printing, maintaining your computer and other office-related purchases may be tax deductible.

The best way to know if your expense is eligible for deductions? Talk to your tax professional. They’ll be able to direct you best in navigating your deductions, come tax season.

What CAN’T You Deduct from your taxes?

After reading the list above, you’re probably starting to think that there’s nothing that you can’t deduct from your taxes. Unfortunately, there are some things that are not eligible for deductions.

This includes any home or personal phones that you own, and the expenses surrounding them. It also includes travel costs on personal or local trips. If you are commuting to the office to get to your truck, then that commuting time and gas is not eligible for deductions. The clothes you choose to wear while driving are also non-eligible. The general rule of thumb, any expense unrelated to your job is non tax deductible.

Which Tax Forms Will You Need?

While we already mentioned that you will be dealing with two different kinds of taxes, self-employment and income taxes, there are also multiple forms you will find yourself filling out. The main forms that truckers need to know about come tax season is Form 2290 and Form 8849.

Form 2290

IRS Form 2290 must be filed if you own a heavy weight vehicle of 55,000 pounds or more. This is perhaps the most important IRS tax form for truckers, and you will need to pay the tax and file the return ahead of the deadline to avoid penalties. This form is also known as the Heavy Vehicle Use Tax (HVUT)

As with other tax forms, there are a few different uses of Form 2290. Besides paying your heavy truck tax, you can also claim a credit for any taxes paid on a stolen or destroyed truck, or a truck that traveled less than 5,000 miles. You can also report amendments to a previously filed Form 2290, report gaining a used taxable vehicle that is tax-suspended, and a few other uses.

You may be exempted from filing Form 2290, in which case you’d file an exemption form instead. A few reasons someone may be exempt is if the vehicle they use is owned or operated by Federal or State governments, the taxable vehicle has a dual registration, the vehicle is being used under a dealer’s tag, license, or permit, or if the vehicle is exclusively used for logging materials. If you believe you may be exempt from Form 2290, you should talk to your tax professional for confirmation.

After filing your Form 2290, you will receive your IRS watermarked Form 2290 Schedule 1. This is a proof of payment for the Form 2290 you filed. If you filed manually, The IRS will send you a copy once your 2290 tax return is processed. You’ll want to keep your Schedule 1 with you at all times, as it is mandatory to have one to operate your truck on public highways. The Schedule 1 form is also needed to renew your truck’s registration, claim a refund for any overpaid taxes, to lease your truck, and more. Keeping this document safe is imperative to operating your business.

Form 8849

The IRS Form 8849 can be used to claim a refund on excise taxes filed on your Form 2290. Another main usage of this form is claiming fuel refunds, however, not every fuel expense falls under that category, so it’s better to check with your tax service provider before completing this form.

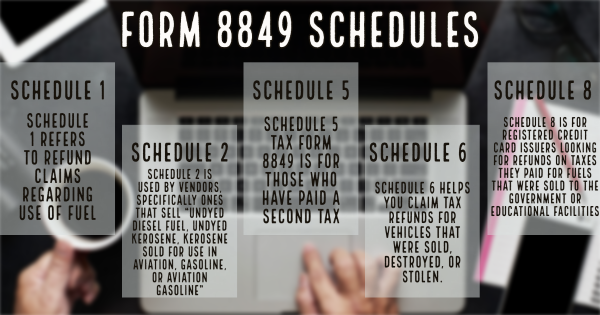

Form 8849 Schedule 6 is specifically used for those who overpaid taxes on Form 2290 on sold, stolen, or destroyed trucks after the 2290 tax period. You should also be aware of Form 8849 Schedule 1, Schedule 2, Schedule 5, and Schedule 8. Check out the graphic below to see the specifics for all Form 8849 Schedules.

How Can You Stay On Top of Your Taxes Throughout the Year?

Given everything listed above, you might already find yourself feeling overwhelmed. But don’t panic! There is one task you can do that will always help you during the tax season, and that is record keeping. Keep track of all the money that comes to you and every expense you pay for your trucking business. While some people prefer the classic pen-and-paper method for record keeping, there is a host of technology out there that can assist you in this task. From Excel spreadsheets to online platforms, you can keep a clean record of all of your expenses and paychecks easily. You should also file away all of your receipts in a folder so you can access them later when you need them.

Of course, you can always hire a bookkeeping service as well. If you are not as diligent in keeping track of all your expenses, or you want to focus more on your business, bringing a professional bookkeeper onto your team really helps. They’ll be able to track these deductible expenses in a streamlined fashion, and keep you well-informed about the tax season and estimated quarterly tax payments.

And remember what you learned in school: honesty is the best policy. You shouldn’t shell out for flashy or costly upgrades or parts just to try and get a larger deduction on your taxes. Be honest about the details you file in your taxes, as chances are, you will still find yourself with a lot of deductible expenses at the end of the day.

Should You Hire a Professional Company?

It’s easy to get lost in all of the deductions and forms that surround truck taxes. Thankfully, there are multiple avenues to file your taxes correctly and maximize your deductions and refunds. One route many people take is to hire a professional company to prepare your taxes. This has its benefits, as it takes filing taxes off your plate so you can focus on your business. These companies tend to charge a fee. You’ll also need to weed through the different companies to find someone that is well-versed in trucking taxes.

Another option is to choose an IRS authorized e-filing platform, such as eForm2290.com. eForm2290.com allows you to easily track and file your HVUT taxes online, so you can be the master of your own business and finances.

We also provide 24/7 customer support, which means you’ll always have someone to turn to for any questions during filing. You will get your IRS watermarked Schedule 1 copy within minutes, and provide free VIN corrections as well as retransmission services for rejected 2290 returns.

We offer a simple, safe, and seamless method of filing your taxes. As experts in the field of truck taxes, we have an abundance of resources available on our site (like this guide!) to help you confidently file your trucking taxes.

If you’re looking to find out more about our services, or you have other questions about trucktax, contact us today!