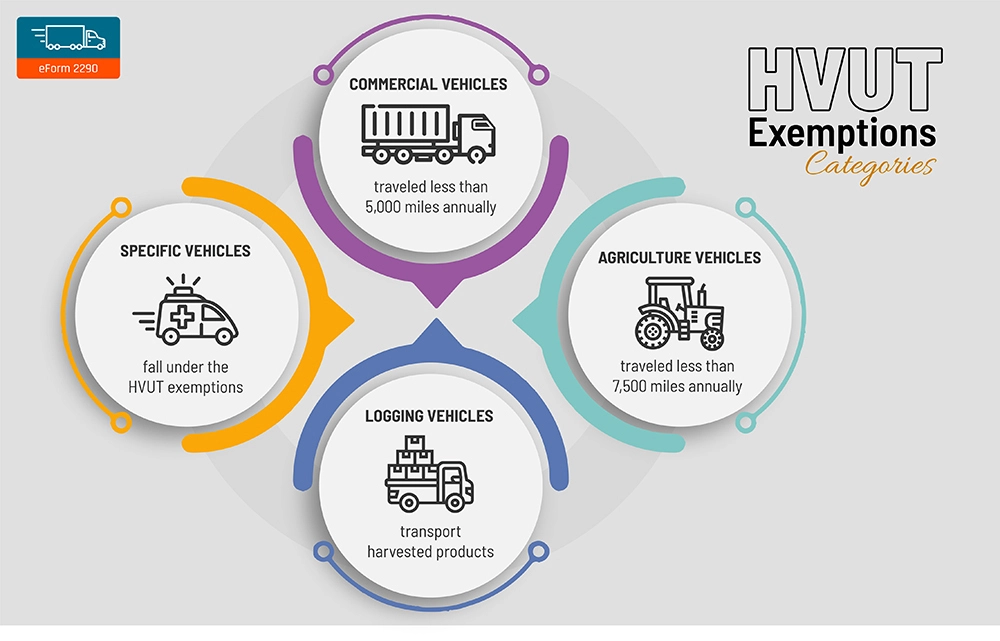

While filing your truck taxes, it is important to know the HVUT exemptions. Several vehicles fall under this HVUT exemptions category, namely:

- Commercial vehicles that have traveled less than 5,000 miles annually

- Agriculture vehicles that have traveled less than 7,500 miles annually

- Specific vehicles that fall under the HVUT exemptions (read more about them below)

- Logging vehicles that transport harvested products

Let’s examine them in more detail.

1. Suspended Vehicles

The taxable gross weight of heavy vehicles must be 55,000 pounds or more. It must also have crossed the 5,000-miles limit annually. If your vehicle has not crossed the 5,000 miles limit in a given tax period, it falls under the tax-suspended or suspended vehicle category.

If your vehicle falls under this HVUT exemption, you must still file Form 2290 to report to the IRS that your vehicle is tax-suspended.

Note: The taxable gross weight of semi-trucks may vary. Kindly complete the necessary checks before HVUT filing.

2. Agricultural Vehicles

An agricultural vehicle is a registered highway motor vehicle that is primarily used for farming purposes. Farming purposes include clearing land, repairing fences & farm buildings, building terraces or irrigation ditches, cleaning tools or farm machinery, and painting.

If your vehicle is used for operations such as canning, freezing, packaging, or other processing operations, it will not be classified as an agricultural vehicle, and you must file your HVUT taxes.

3. Exempted Vehicles

If your vehicle is used or operated by government agencies or falls under any of the below categories, it will be classified as a tax-exempt vehicle, and you don’t need to make any HVUT payments. Tax-exempt vehicles are owned or operated by:

- The Federal Government

- The District of Columbia

- A state or local government

- The American National Red Cross

- A nonprofit volunteer fire department, ambulance association, or rescue squad

- An Indian tribal government but only if the vehicle's use involves the exercise of an essential tribal government function; or

- A mass transportation authority is created under a statute that gives it certain powers normally exercised by the state

- Qualified blood collector vehicles used by qualified blood collector organizations

- Mobile machinery that meets the specifications for a chassis as described under specially designed mobile machinery for non-transportation functions later

4. Logging Vehicles

Logging vehicles are vehicles exclusively used to transport harvested products from one forested site to another. You will not have to pay heavy vehicle use tax if your truck:

- Is used exclusively for the transportation of products harvested from a forested site, or

- Exclusively transports the products harvested from the forested site to and from locations on a forested site (public highways may be used between the forested site locations); and

- Is registered as a highway motor vehicle used exclusively for the transportation of harvested forest products. A vehicle will be considered to be registered under the laws of a state as a highway motor vehicle used exclusively in the transportation of harvested forest products if the vehicle is so registered under a state statute or legally valid regulations.

Products harvested from the forested site may include timber that has been processed for commercial use by sawing into lumber, chipping, or other milling operations if the processing occurs before transportation from the forested site. Logging vehicles are taxed at reduced rates.

Once you find out the category of your vehicle, you can complete your HVUT filing effortlessly through an IRS-approved e-filing service provider like eForm2290.com. Once filed, you will get the proof of heavy vehicle use tax payment or Schedule 1 within a fixed time. Make the best out of the HVUT exemptions!

Wondering how much 2290 is per year for your truck(s)? Find out by visiting eForm2290.com!